Last updated: Sep. 22, 2023

As we wind down another challenging year of dealing with historic inflation, the last thing you want to think about is taxes.

However, with profit margins tighter than ever, this is exactly the right time to take steps to minimize your tax burden.

For incorporated businesses, this starts with understanding your income tax rates.

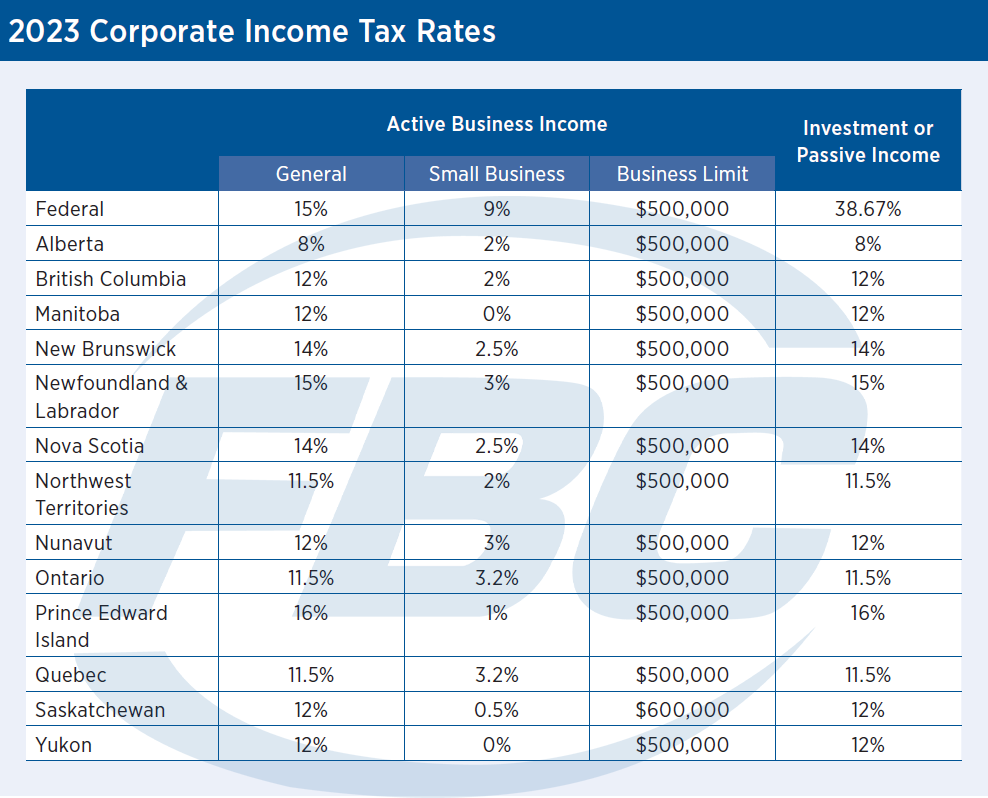

2023 Canadian corporate income tax rates

While there are many benefits to incorporating to a business, the largest is significant tax savings.

Those businesses registered as Canadian Controlled Private Corporations (CCPC) can take advantage of the small business tax deduction and pay a lower federal tax rate on the first $500,000 of active business income.

As for passive income, any CCPC that holds in excess of $50,000 of passive investment income will see a reduction in the amount that their active income is eligible for the small business tax deduction.

We have put together an easy reference table below of corporate income tax rates in Canada for 2023.

2023 corporate tax filing deadlines

As always with corporations, your tax filing deadline is dependent on your fiscal year end.

According to the CRA website:

“When the corporation’s tax year ends on the last day of a month, file the return by the last day of the sixth month after the end of the tax year.

When the last day of the tax year is not the last day of a month, file the return by the same day of the sixth month after the end of the tax year.”

For example, if your tax year end is December 31, then your filing deadline is June 30; if your tax year end is September 23, then your filing deadline is March 23.

It pays to stay on top of your tax filings. According to the CRA: “You must file a return no later than three years after the end of a tax year to receive a tax refund.”

Are your minute books up to date?

While not part of your actual income tax filing, minute books are a legal obligation for any corporation as per the Canada Business Corporations Act.

As a refresher, minute books contain pertinent business information (like board meeting minutes and major financial transactions) and are subject to review by the government.

With so many priorities pulling your attention, it is easy to let minute books fall of the radar. That said, gathering this information before fiscal year end saves time and headaches later.

For more information about minute books, please see our blog, “Does your incorporated business have a minute book?”

[Free Download] The Ultimate Guide to Tax Planning and Preparation

For Canadian farmers, contractors, and small business owners, tax planning and tax preparation aren’t once-a-year events. They require an ongoing strategy focused on meeting today’s goals and building wealth for the future.

To help you get started, we created the Ultimate Guide to Tax Planning and Preparation for the Canadian Farmer, Contractor, and Small Business Owner, a comprehensive resource that provides deeper insight into tax planning and preparation.

Want to learn more?

With more than 70 years of Canadian tax experience, we offer unlimited corporate tax preparation help, support and tax advice for one flat fee. Our tax experts will run the numbers to create a custom T2 corporate tax return that helps minimize headaches and maximize your tax savings.

Leave your unique tax situation to us. We’ll get you every dollar you deserve. Book online or call us at 1-800-265-1002.