Contents

Last updated: Dec. 22, 2023

Small business owners are entrepreneurs. Known for having great ideas, they’re passionate about their products or services and want to change the world. This laser-sharp focus often won’t leave them with enough time or energy to handle their taxes.

It’s never too early to start thinking about tax planning strategies and how to effectively reduce your tax bill, especially when there’s still time to make positive changes to your tax situation.

In addition to understanding the small business tax rate, here are some top tax planning tips for Canadian business owners.

If you want to reduce your tax burden and take advantage of all the tax deductions available to you, you need to collect receipts for all business-related activities.

We know you’re busy, and keeping track of your receipts may not be at the top of your to-do list. However, all your business expenses can add up quickly—no matter how small or large. Business expenses can include everything from online advertising costs to promotional materials such as business cards to interest paid on property you buy for your business.

Read our list of top small business tax deductions so you don’t overlook any business expenses.

What’s the purpose of keeping original receipts? The Canada Revenue Agency doesn’t accept credit card statements as proof of business expenses. If the CRA asks to verify your claims, you must provide the original receipts. It’s ideal to keep them for at least six years after your last Notice of Assessment because this is as far back as the CRA will go if an audit occurs. You can keep either your physical receipts or digital copies.

2. Take Advantage of Business-Use-of-Home Expenses

The majority of Canadian entrepreneurs are small business owners, many of whom operate their businesses out of their homes, which offers tax advantages.

If the workspace in your home is your principal place of business or you use it on a regular and ongoing basis to meet with customers, you can claim a percentage of your home expenses.

The percentage is typically determined by the size of your office in relation to the total size of your home. If your office takes up 10 percent of the home’s total footprint, the business use home percentage would be 10 percent.

You can deduct a portion of all the home expenses that relate directly to operating your business, including:

- Utilities

- Cleaning materials

- House insurance

- Property taxes

- Mortgage interest

- Capital cost allowance

3. Claim Non-Capital Losses

If your business has a non-capital loss (i.e., your expenses exceed business income) during a certain year, you can figure out which year you can use this loss to decrease your income tax bill.

Non-capital losses can be used to offset income, and the loss can be carried back three years or carried forward up to 20 years.

With the help of a tax specialist who has experience working with small business owners, you can decide if it makes sense to use the non-capital loss in the current tax year, carry the non-capital loss back to recover income tax you’ve already paid, or carry it forward to offset a larger tax bill.

4. Manage Your RRSP and TFSA Contributions

Registered retirement savings plans (RRSPs) and tax-free savings accounts (TFSAs) are excellent ways for Canadian entrepreneurs to maximize their tax deductions, but the total amount you contribute depends on how much your income fluctuates each year.

Contributions to an RRSP are considered tax-deductible, so you receive immediate tax relief and tax-sheltered growth. To maximize the benefits of the RRSP, you should contribute to it when you’re in a higher tax bracket. Because any unused contributions from previous years can be carried forward, it may be best to hold off on making RRSP contributions until a year when you expect to make a high income.

With a TFSA, you won’t receive any up-front tax relief, but your money will accumulate tax-free, along with capital appreciation, bonds, and other interest-bearing financial products.

If you’ve maxed out your RRSP, you can put money or investments into a TFSA.

5. Incorporate Your Business

Business owners looking to make the most of the small business tax rate in Ontario should consider incorporating their business.

Depending on what your business does and in what province you operate, incorporating a business can lead to tax deferrals.

When you incorporate your business, you can take advantage of certain tax rates and benefits that are not available to unincorporated businesses, such as capital gains exemptions when you sell the business and income splitting.

One major advantage of incorporating your business is the lower corporate tax rates. For Canadian-controlled private corporations claiming the small business deduction, the net tax rate is 9 percent. By comparison, if you register the company as a sole proprietorship, you pay the personal income tax rate on all profits.

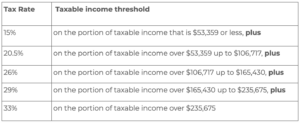

Below are the 2023 federal tax rates for individuals, set by the Government of Canada. The rate you fully pay is dependent on the province in which you operate your business, as provincial income tax rates apply in addition to federal rates. These rates apply to taxable income after any deductions, credits, or exemptions are applied.

Federal income tax rates for 2023:

Another big advantage of incorporating a small business is limited liability. When a business is incorporated, it’s considered a separate entity from the owner or shareholders. This means that the incorporated business technically owns and operates the business and is responsible for any liabilities—not the individual owner or shareholders. However, the director may still be liable in some cases. We suggest you speak to a tax professional about exceptions.

If your small business involves a great deal of risk, incorporating it could also protect your personal assets from creditors and unwanted lawsuits.

[Free Download] The Ultimate Guide to Tax Planning and Preparation

For Canadian farmers, contractors, and small business owners, tax planning and tax preparation aren’t once-a-year events. They require an ongoing strategy focused on meeting today’s goals and building wealth for the future.

To help you get started, we created the Ultimate Guide to Tax Planning and Preparation for the Canadian Farmer, Contractor, and Small Business Owner, a comprehensive resource that provides deeper insight into tax planning and preparation.

To find out more about how we can support your business, take a few minutes to connect with us!

Book My Free Consultation Now