Contents

Last updated: Mar. 8, 2016

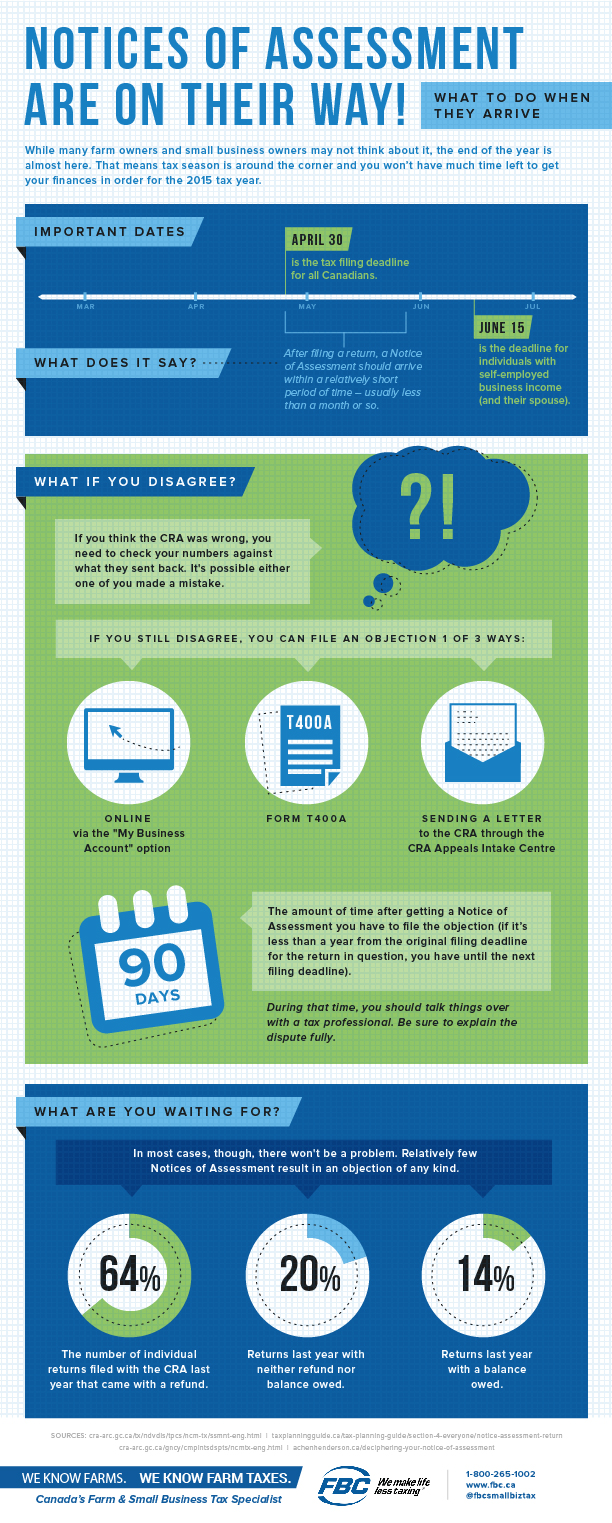

Millions of Canadian small business owners may not yet be thinking about their annual tax filings, with April 30 so far away.

However, the end of the year is often the best time to start planning for how they’re going to handle this crucial financial step.

Once they do, though, it’s important for those entrepreneurs to be aware of what might happen next.

When a Notice of Assessment Arrives

Those who have self-employed business income, as well as their spouses, actually have until June 15 to file, but regardless of their individual filing deadline, what happens next is going to be the same.

Within a month or so, but usually less, they’re going to receive a Notice of Assessment from the CRA, which will spell out whether they owe money, owe nothing, or may be in line for a tax refund.

The vast majority of filers fall into the latter category, and only about 1 in 7 actually end up owing anything.

However, it’s still vital to make sure you know where you stand so that you can take the next steps.

Potential Problems Can Arise

However, there may be times when a small business owner may disagree with what their Notice of Assessment says.

Fortunately, those with concerns about their notices have a number of ways available to them to dispute what was sent to them, including going online, filling out a T400A form, or sending a letter to the CRA Appeals Intake Centre.

Usually, though, they have the greater of either 90 days after they get the notice, or a year out from the normal filing deadline, to file their disputes.

That will provide both the entrepreneur and their tax specialist the ability to talk about the issue and see whether an error was actually made on the part of the CRA.