Last updated: Jul. 11, 2013

CRA is mailing Notice of Assessments to taxpayers and small businesses and there are many that have attracted the attention of CRA to be selected for audit.

In fact, in the future, there will be more audits and more focus on compliance and collecting tax debt.

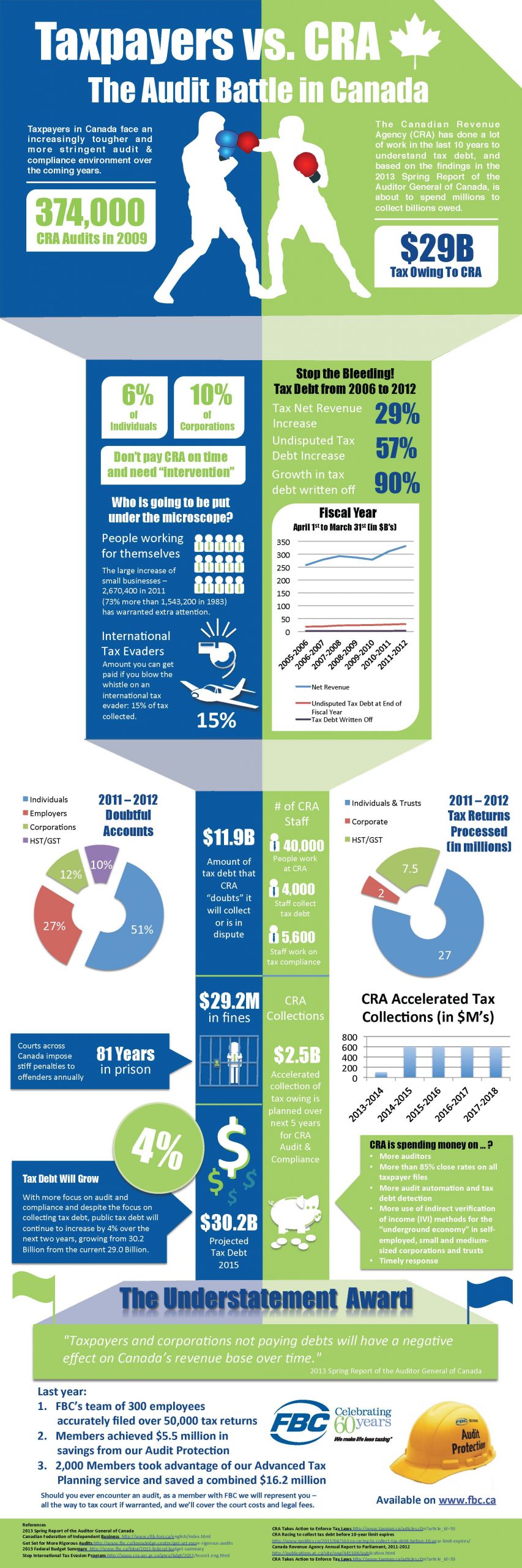

The Canadian Revenue Agency (CRA) has done a lot of work in the last 10 years to understand tax debt, and based on the findings of the 2013 Spring Report of the Auditor General in Canada, is about to spend millions to collect billions owed.

Our Infographic focuses on stats around Audits and Tax Debt in Canada and shows some alarming trends!

TaxPayers vs. CRA: The Audit Battle in Canada — an Infographic by the team at FBC.ca