What you should know when making a will in Canada

Last updated: Jun. 10, 2019

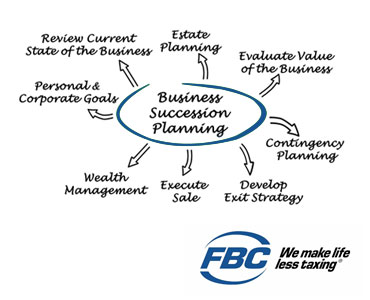

Will planning may not be at the top of your to-do list, but a will is the foundation of your estate planning, helping protect your family and assets. And the sooner you make a will, the better. You are not legally required to make a will, but in Canada if you … Read more