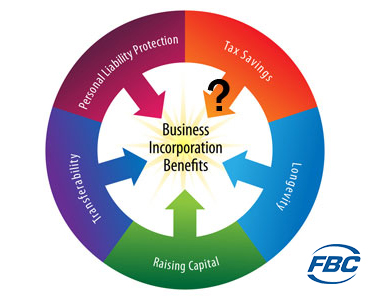

Farm Businesses in Canada Whether it’s a family farm that has been in operation for generations or it’s a start-up, there’s an attraction to being your own boss and working outdoors. It also doesn’t hurt that farming in Canada has become more lucrative over the years. The government of Canada offers a number of incentives … Read more